Bus-Tec Pty Ltd., became registered 1 July 2003, virtually as a result of frustration due to poor investment planning reporting standards. However, it's associate company, Financial Management Group Pty Ltd. (FMG who holds an Australian Financial Service Licence No. 258920), whose origins date back to October 1983 - almost the beginning of the investment advisory industry in Australia.

The Need For Efficient Solution Making Models lacking for Complex Investment Decisions.

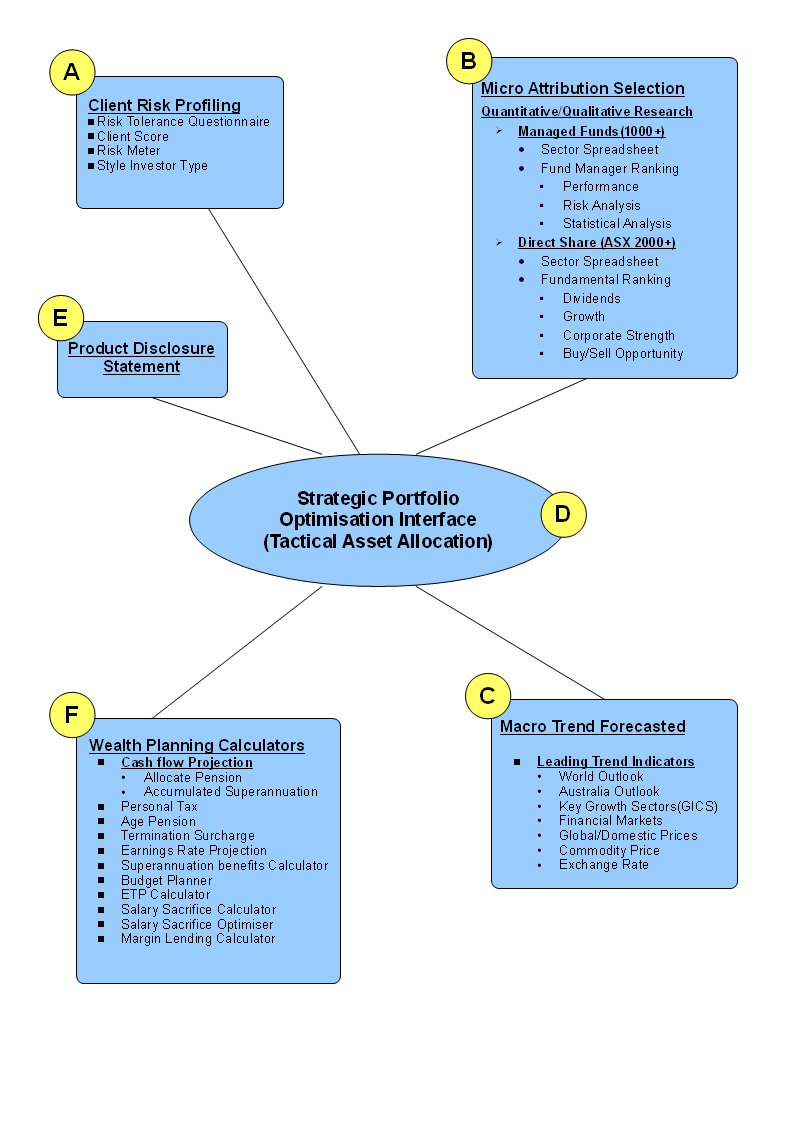

Bus-Tec Pty Ltd. has created a design reality decision-making model regarding strategic solutions for client investment portfolios. Hence, "THE BUSINESS COACH MODEL" (BCM) capitalises on the poor Platform Providers Administrative Research that lacks statistically rich in E-commerce application with centralised database by applying landscaping with multi-functional layers and customised research analysis landscaping for personalized investment portfolios. More importantly, the process currently represents a client's needs based planning essentially to the ASIC PS 146 investment strategies criteria. The Financial Planner has educated the client, the client has made the informed decision and the Dealer Group and Financial Planners have therefore both significantly lowered their business and personal risk responsibility.

The client is not putting their money in a black box that can't be explained. "THE BUSINESS COACH MODEL" helps Financial Planners to understand the logic behind investment Managers and Direct Share decisions and offers investors a range of funds that is tailored to their investment objectives for risk tolerance and their concern for more disclosure.

The important advantage of the BCM over traditional managers is that it acts as an excellent Risk Management Tool, which can deliver returns, with a much lower overall risk correlation to that of traditional shares and bonds. An investment option such as BCM can offer an independent value added stream from traditional asset class of fund managers or direct shares; therefore this makes it a powerful tool in a traditional investment model.

Principal - GEOFFREY GORDON SALTER - B. Bus., C.P.A., C.F.P. A.F.S.L.

- Bachelor of Business

- Certified Practicing Accountant

- Certified Financial Planner

- Australian Financial Services Licence No. 264928

With 46 years in the Securities industry extending over Banking, Finance and Investment Industry and during the past 28 years has been directly involved as Principal of Financial Management Group Pty Ltd. providing Retirement Planning to a number of Corporations and Institutions, such as:

State Electricity Commission, Melbourne Water, Telstra, Gas and Fuel Corporation, Federal and Victorian Public Services, the Stevedoring Union, B.P. Australia, Coles Myer, National Australia Bank and Ford Australia.

Testimony To Seeing The Light

Since April 2002, Financial Planner Geoff Salter has not used under-performing big brand name fund managers, preferring to adopt a more intelligent and sensible approach to FM/DSO that does not entail picking yesterday's performers.

He quotes, "My interest in risk assessment, ie. quantitative analysis, asset allocation and client's risk tolerance, came about because I was frustrated by the state of the continuous negative returns of my clients' portfolio. However, in the eyes of the fund manager who measure their achievements against the industry benchmark regarded these results were highly satisfactory."

Salter says while he was always suspicious of big name fund managers, it wasn't until 2005, that he had the building blocks and infrastructure available to put Alpha investment model into practice.

The advent of the Business Coach Model (BCM) solved this problem as it allows access to institutional funds with pure exposure to asset classes. This shifted the emphasis away from particular Fund Managers/Direct Shares to an emphasis on managing risk through both asset allocation and asset investment class.

In analysing the style of Fund Managers/Direct Shares, Salter found that his Absolute Concentration Strategy or Alpha/Beta approach, recognises when investing according to Global Industrialised Characteristics Standards (GICS) and close to the S&P/ASX 300 and he also uses the same system for analysis for Direct Share Portfolio. Using this approach, Salter argues he can control asset allocation up to 90 per cent of the accuracy response of the volatility return and 70% response chance regarding the value added return:

- This enables the unique process of FM/DSO picking and market timing through a database deep quantitative, qualitative, factor metrics and macro trend analysis;

- The variation in a portfolio's return through appropriate asset allocation of the asset classes that match the client's risk tolerance. Therefore if a proper suitable gap analysis or asset allocation model is done initially, many problems could be avoided;

- Also increase expected returns is to increase exposure to the better asset classes which is driven by the market trends which is precisely a study of relative strength indexes based on economics consensus because of its enhanced global predictability qualities;

Salter says many Financial Planners tend to follow star fund managers because both the structure of the industry and education of the Financial Planners are flawed which for the planners end up with higher MERs and unpredictable heroes which leads to client dissatisfaction and unfullfilment.

Also, using a good risk assessment tool the BCM can become a good professional liability protection against bad financial planning business practices.

BCM Portfolio Construction Interface - All Profiling System

BCM Portfolio Construction Interface - Symmetry of Distribution supporting stand-alone modules all risk, all performance (blend, growth, value), all mean variance, all fundamental, all asset class, all sectors, all historical evaluation, all forward evaluation, all quantitative, all qualitative, all micro, all macro, all economists consensus, all rational asset class, all retraceable asset allocation, all ranking increase decrease risk return, all investor style type and all time series with the most comprehensive range of deep quantitative research tools and relative strength economic indicators, systematically used for determining top quartile performing fund managers in global and domestic markets which presently gives us access to historical data and performances on over 1000 Managed Funds and 2000 ASX Listed Securities diversified over 41 and 27 business sectors respectively.

Therefore, these sophisticated strategically developed analytical tools enables BCM to analysis the needs and resource of clients' financial goals and then combine these with the skills and expertise of the organisation to marry these factors into an integrated plan.

Clients therefore can be confident in the knowledge that the investment products recommend to them are extensively researched, thus reducing the risk element associated with investing in FM/DSO.

The Group's services are underpinned by both a comprehensive external research house and in-house research facilities which assess investment opportunities, track and monitor investment products and assess trends on a global basis, updated regularly through its sophisticated software system and research database.

These functions are outsourced by -

Morningstar - Quantitative and Qualitative Research

Through Morningstar's extensive statistical (*mean variances) research database, Financial Management Advisors is able to track and monitor the historical performance, current and historical prices and regular up-to-date product information reports, in excess of 6000 investment trust products.

| Statstistic | |

|---|---|

| PERFORMANCE | Income, Growth, Total Return |

| RISK MEASURES | Arithmetic Mean,Standard Deviation,Skewness,Kurtosis, Sharpe ratio, Sortino Ratio, Downside Volatility,Upside Volatility |

| RELATIVE RISK MEASURES | Alpha, Beta,R Square, Information Ratio,Treynor Ratio, Correlation Tracking Error, Capture Up Ratio, Capture Down Ratio, Batting Average |

Aspect Huntley

Aspect Huntley provides one of the most comprehensive, high quality market information and statistical research analysis system on the market, which keeps us informed that helps us make the best investment decision for our clients.

It provides over -

- 70 individual, fundamental tools for research categorised as dividend stability (15), earning stability (25), financial strength (15) and Buy/Sell Opportunity (15)

- 1600 ASX companies

- daily report summaries of global markets, company research, economic updates

- advance trading toolsand

- relevant news articles.

BCM Macro Economics - Leading Indices

BCM Macro Economics leading indices are designed to anticipate and identify turning points in the World and Australian economy.

The Leading Index is contained in BCM Macro Economics composite reports produced quarterly. As well as examining Australia's leading indicators, the report also studies movements co incident and lagging indicators of economic activity in the country, along with comparative data from overseas.

These Leading Indexes, which consist of twenty or more leading indicators, are presented by five typical main Composite Indicators, ie. World Outlook, Australian Outlook, The Growth Sectors, Financial Markets and Domestic Wages and Prices. These include real money supply, stock market price indices, residential building approvals, non-residential building approvals, overtime hours, company profits, real unit labour costs, manufacturing material prices, unemployment rates, Public sector contribution to output growth, terms of trade, net exports, net imports, exchange rates, Balance of Payments, relative strength movement of business sectors, long and short-term interest rates, yield spreads between foreign and domestic interest rates, commodity prices, the lagged impact of output on prices on productivity growth, wages, material, inflation and import prices.

Business Coach Model (BCM) - System And Method For Analysing Risk Associated With An Investment Portfolio Style As Absolute Concentrated Risk Adjusted Relative Benchmark, Specifically Targeted Correlation Efficient Frontier

The success of a financial planning business depends upon the holistic financial planning services and moreover, clients investment portfolio risk/performances are central to a healthy client relationship.

However, Financial Planners are facing a crisis of confidence. The most common areas to be addressed are compliance systems, communicating with clients, record keeping and especially understanding risk management technology.

Financial Planners are the gatekeepers of investment dollars. Asset consultants advise on such things as asset allocation, investment strategy and fund manager selection. People's money represents a lifetime of work as they have an emotional attachment - it represents a lot more than the market value. To walk in to a stranger and give that control away is a huge issue so they want to retain control or at least have a perception of control.

To the consumer, the success or otherwise will depend on the quality of information they get. It will free consumers to move from poorly performing funds, despite being sold a little more expensive service.

It is a tough market; therefore you have got to have the latest technical tools that money can buy. Our software encourages the need for greater due diligence (ie. according to our essential quadratic (4) pillar filters A-D below and again see diagram attached) from financial planners for investors by in-depth gap analysis associated with achieving the desired risk/performances of a client's investment portfolio.

Financial Management Group Pty Ltd

A.B.N. 48 063 077 985

AFS Licence No. 258920

Address: Level 13, 60 Collins St , Melbourne Vic. 3000 Australia

Tel: (03) 9639 6001

Fax: (03) 9600 2957

Email: finmangrp@bus-tec.com.au

View Larger Map

Home

Home Strategic Profiling

Strategic Profiling Document

Document Overview

Overview About Us

About Us Who we are

Who we are Behind the company

Behind the company Glossary

Glossary