The Standard By Which Other Portfolio Construction Systems Are Judged

The Need For Efficient Solution Making Models lacking for Complex Investment Decisions

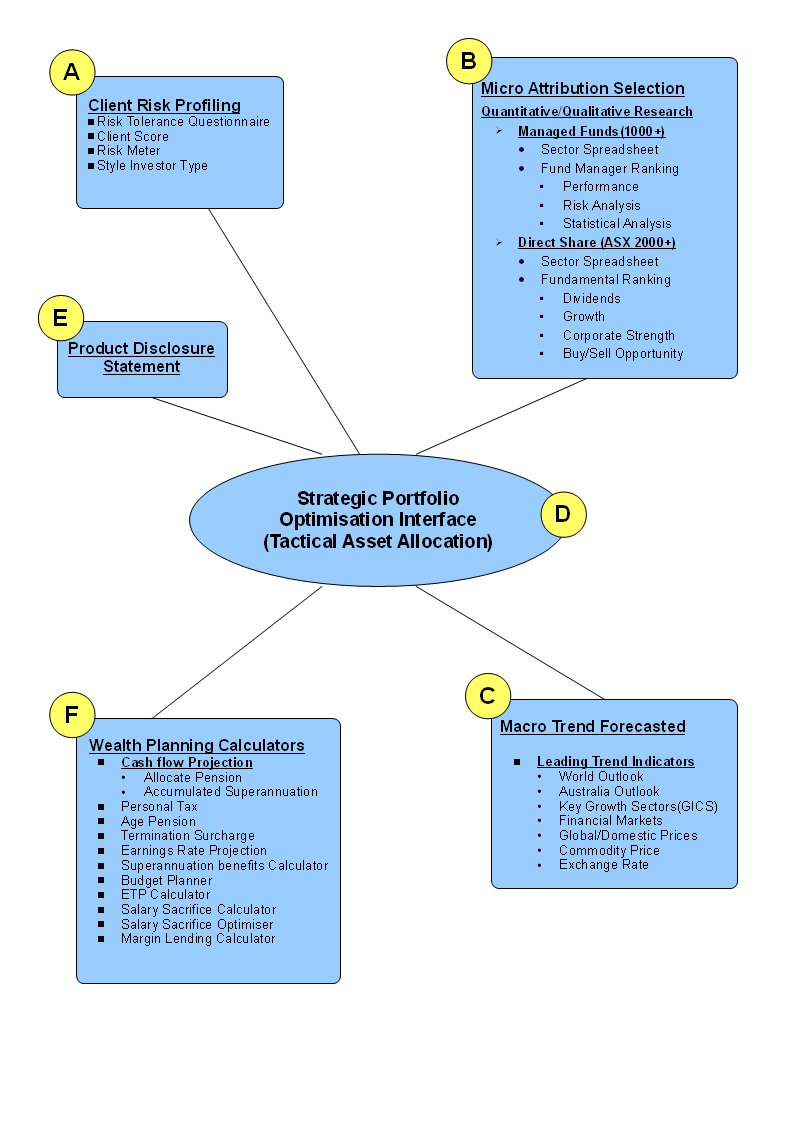

Bus-Tec Pty Ltd. has created a design reality decision-making model regarding strategic solutions for client investment portfolios. Hence, "THE BUSINESS COACH MODEL" (BCM) capitalises on the poor Platform Providers Administrative Research that lacks statistically rich in E-commerce application with centralised database by applying landscaping with multi-functional layers and customised research analysis landscaping for personalized investment portfolios. More importantly, the process currently represents a client's needs based planning essentially to the ASIC PS 146 investment strategies criteria. The Financial Planner has educated the client, the client has made the informed decision and the Dealer Group and Financial Planners have therefore both significantly lowered their business and personal risk responsibility.

The client is not putting their money in a black box that can't be explained. "THE BUSINESS COACH" Model helps Financial Planners to understand the logic behind investment Managers and Direct Share decisions and offers investors a range of funds that is tailored to their investment objectives for risk tolerance and their concern for more disclosure.

The important advantage of the BCM over traditional managers is that it acts as an excellent Risk Management Tool, which can deliver returns, with a much lower overall risk correlation to that of traditional shares and bonds. An investment option such as BCM can offer an independent value added stream from traditional asset class of fund managers or direct shares; therefore this makes it a powerful tool in a traditional investment model.

How BCM Takes On The Fund Of Funds Responsibility To Serve His Investor's Requirements

The Fund of funds investment vehicle continues to gain investor's dollar and adviser's support as each seeks easier ways to invest; however, the question is whether the funds are a suitable choice across the board.

No matter who the provider of the choice of funds is, whether it's the fund of fund manufacturer or the dealer group, if they were to engage the services of BCM as their asset consultant to manage this activity, the objective will be to identify the best of a breed of fund managers and to continue with them in such a way as to satisfy the stated investment objectives. BCM, as asset consultant, whether the task is outsourced or transplanted into Platform or Dealer Group, will be responsible for hiring and firing fund managers, blending investment styles, deciding asset classes exposure and relative weighting of fund managers.

Consistent with this has been the proliferation of specialist investment houses focusing purely on delivering investment performances and nothing else. Financial Planners are attracted to the funds of fund approach for the same reason it allows them to exploit their core competencies but the recent decline of the bull market and the fading capacity of some of these managers to deliver excess returns is putting the traditional selection process under pressure.

The life of the typical dealer principal is increasingly complex. Their responsibilities include the provision of professional advice compliance, due diligence, administration, business management and marketing. It is not surprising that some are now conceding to Business Coach Model's statistically link "black box" for their solutions for active selection, monitoring and re-weighting of asset classes of fund managers.

Does The Current Concept Of Internal Fund Of Funds Serve The Interest Of Investors

Financial Planners and investors have already adopted the popular Master Fund and Wrap Account concept (85% acceptance rating), realising the value of diversification over several different business sectors and migrating from one fund option to another but this all important shift in relation performance differentials between product options and asset classes is not quantified against the investors risk profile which remains the same.

Obviously the inherent problem with external fund of funds managers, ie. Core Satellite Approach is it doesn't suit all investors. Many of us know exactly who is managing our money and how. The flip side of fund of funds simplicity is that the investment objective process and performance of the underlying fund manager is far from explicit and this may lead to investor frustration.

Our approach may be to utilise part core satellite approach and to surround it with high performance specialists. This is where the user friendly Business Coach Model would be controlled by the Financial Planner, thus allows acceptable risk return outcomes within the clients acceptable risk profit.

Beating The Mind Trap

Overcoming your natural negative emotions of another seemingly complex piece of software will become the key to investment success. One thing is for sure, the Business Coach Model is such a powerful tool yet so user friendly, it makes the Financial Planner feel the power lies within them.

The first stage is where Financial Planners are looking for tips, like looking for a guru who will tell them what to do and are they seeking a solution to an investment problem. What they need to progress to the point where they realise that the questions they ask are trivial and that they are most likely to do well if they make their own decisions.

The second stage is where the neophyte Financial Planners come to realise the need to learn to make their own decisions or what they need to realise is that they are like Don Quixote tilting at the windmills because this search for the perfect method is still looking out side themselves for the solution. This is when they begin their research for the holy grail or the perfect system. Most of this research revolves around identifying the fund mangers that consistently outperform their sector specific peer group over a medium to long term of 3 to 5 years.

The third stage is where those Financial Planners who have stayed the course learn the holy grail lies within them. They appreciate that the investing results in what they do and some external system. In other words, they realise that their profits or losses are created by their actions and that they can change what they do to improve their performance.

So investing success depends on the way we make decisions. To make good decisions, we need a set of rules in the form of investing planning and the discipline to follow those rules. Our investment plan will have rules for when to buy, when to cut losses, when to take profits and how much money to commit to a single investment. How well disciplined we are in following these rules, depends upon our beliefs, emotions and skills in making decisions. This suggests that investing is really a mind game. Our investment results flow from how well we deal with many emotional biases, decision making biases, personality flaws, beliefs and attitudes that we all have to some extent.

Overcoming them is first a matter of coming to a realisation that they exist and that they apply to us. Most beginners do not even know that these problems exist. As they become aware of them, they also have to get to the point when they admit that these issues apply to then personally. Until they get beyond the denial stage, investment success will remain outside their grasp. There are many common ways in which we all sabotage our investment success through the way we think about investing and this is not due to low intelligence because the smartest investors are just as susceptible to them. Instead, they flow from the way we naturally experience emotions, tackle likes challenges, deal with information and make decisions. A good example of a psychological mind trap is called framing. The idea that we mentally put things into categories so that we can deal with the complex world we live in which can lead us into bad decisions blinded by the way we defend things.

The Ever changing Client Base Environment

History does not repeat itself. Business cycles, market trends and business opportunities, if missed 10 years ago, do not represent themselves for a second bite of the cherry.

The master fund phenomenon of the late 1980s and early 1990s was a watershed for the industry. It changed the way the industry functioned by invoking a major power shift from the fund managers that held the retail client base to the portfolio administrators.

Now the wheel is turning again - this time in favour of the Financial Solution Service Provider. Market consolidation will further hasten this shift and lead to even more rapid changes in the future. This is bad news for industry participants locked firmly in the past. In other words, if you are still using the business models that worked a decade ago, you cannot hope to compete in today's radically different environment.

Does this mean we will see a reduction in the number of market players? Not necessarily. Instead, the market will likely experience exactly the opposite effect. Just as the focus of the industry shifts towards advice and planning - and away from product and administration - dealer groups, stockbrokers and accountants will become branded providers of wealth management solutions to their customers.

A further effect of industry consolidation and the high capital barriers to entry that will impact on the wealth management area will be a decrease in the amount of platforms that are used to build and provide wealth management services. Platforms that survive the 'market-place make over' will be those that deliver the goods to the evolving 'new look' industry.

A Lego Planning Approach To Planning

Over the past 20 years, the role of financial advisors has changed from helping investors select a ready made financial solution to helping them construct that solution from basic building blocks. Two decades ago, most investors selected a single manager to control a balanced portfolio comprising all asset classes; equities, property, bonds and cash. Most institutions did everything from managing the money, to administrating the fund and providing advice and education through tied in-house advisors.

The past 15 years has seen massive changes to this model. Many institutions now focus on either financial advice and distribution or investment management, while naturally there are others that continue to do both. Investment managers are increasingly required to provide the building blocks rather than the entire solution. Financial advisors use these building blocks to build solutions for their clients in much the same way as LEGO allows people to construct various objects using a small number of basic pieces.

The trend towards specialisation and away from the single manager has been driven by a number of factors. The emergence of Financial Planners that are independent of the asset managers has been one reason. Another has been that as performance reporting became more public, 'manager risk' - the potential for underperformance by individual managers - became obvious.

Initially this caused investors to select two or three balanced managers, but later contributed towards the move to specialist managers. An inability to manage all asset classes, particularly by institutions for whom investment management was not their core business, caused them to outsource some asset classes (eg. International equities). Finally, dealer groups, advisors and consultants recognised that they could add value for their clients if they could select high performing mangers in each asset class and customise the asset mix to their clients' specific needs.

Where does this all end? The ability to use the basic building blocks of portfolio construction increases the flexibility of advisors and increases the possibility of tailoring the portfolio exactly to the needs of the investor. However, it also increases the responsibility of dealer groups, and in turn their advisors. They now become responsible for determining the strategic mix, exposure to active management, selection of managers and controlling implementation, rebalancing and tactical asset allocation. Now with BCM, many dealer groups can provide 'model' portfolios for their planners, constructing diversified portfolios using sector specialist managers.

Almost every building block in the over-all financial solution can be purchased separately; the trick is knowing when to use the basic component and when to access a ready-made solution.

For example, without balanced managers responsible for actively managing the mix of asset classes, positive returns can be eliminated and portfolios can be left to drift away from the desired mix according to the performance of each asset class, or be rebalanced periodically to the desired strategic mix. The alternative is for the dealer group or advisor to actively manage the mix of asset classes or hire a specialist tactical asset allocation (TAA) manager. Increased choice creates the possibility of a more successful outcome but also increases the risk of failure.

However, those who are now finding that their clients are shocked by recent market events, should not only be rethinking portfolio construction principles but whether low risk, profiling methodology has continued to do this.

BCM's Superior Gap Analysis Modelling System

BCM approaches this matching process of client's risk tolerance with the choice of appropriate stock selection by scenario testing for the client' expected marginal utility risk which provides the building block solutions necessary for appropriate efficient frontier model.

When markets are choppy and unpredictable, BCM has the ability to shine. The BCM's first aim is to preserve capital (ie. not to be subject to losses with the rest of the market) and only then do they deliver some profits to investors. This superior preservation of capital and returns is possible because the BCM can strategic budget its exposure to the following asset class risk.

- Top performing fund manager over asset class or sector.

- Style mix of fund managers measure overall co-efficient correlation of Risk Management.

- Comparison of chosen fund managers investment against traditional investor type benchmark.

- Multi scenario testing of asset allocation to refine the desired risk factor or benchmark.

With the advent of Modern Portfolio Theory in the 60's, came the notion of a broader macro review of investment portfolio to fund the right mix of investments, concluding that asset allocation represents over 90% as to the degree of portfolio volatility; hence the importance of asset mix cannot be overlooked. The size of your allocation will generally be determined by your objective in making an investment, increase your portfolio returns; reduce your portfolio volatility or a combination of both.

The Financial Planner needs to determine what risk/reward position they are seeking for their client. If the client were risk averse, it would be appropriate to adjust the overall risk of the portfolio according to empirical guidelines benchmark of typical moderately conservative type investor with drop down income performance. However, if the investor is a reward chaser with an equity-like volatility with no regard to associated risks, then little or no tactical asset allocation for risk but still probably appropriate for some sector diversification amongst high return products.

I suggest that for the non-institutional investor of funds, the fund of funds manager approach generally makes sense. A portfolio of multiple managers utilising multiple strategies can be very difficult to achieve the desired client's outcome without BCM's powerful tool that monitor and benchmark and as long as you have done your homework and fully understand the fund manager's selection process as outlined in this Paper, you should be able to sleep well at night in the confidence that the manager is monitoring your investments. The fund of funds manager becomes an expert in both selecting and monitoring individual fund managers and it is their job to both hire and fire managers where appropriate.

This manual monitoring process on 1000+ Fund Managers and ASX 2000+ Direct Shares, without the BCM software takes a certain level of skill and a significant amount of time. The BCM is designed to provide the Financial Planner with a daily, weekly or monthly investment performance report which breaks up the funds in Growth and Income performance over periodical time spans on each strategy employed and any particular change to the portfolio.

Does The Industry Appear To Be Doing Their Job In Delivering Value To Their Clients

Financial Planners who don't know what their administrative platform can deliver are ill equipped to choose the right desktop platform for their business. Desk top functionality starts when back office ends and there is a range of services many Master Trusts and Wraps don't deliver like a scenario testing or risk management for a client's investment portfolio. Your desktop system should be able to defend you against the loss of business to another licensed financial service adviser. Your desktop system should provide adequate support facilities such as modelling and objective based planning. Therefore, Financial Planners are regarded as high-value resources so anything that can be done to take administrative tasks away from them to give them more client-facing time to make them more productive, the better scope for client's profit.

Financial Planners do not know everything, but they should know the basis about the Australian investment markets and the tax system. However, their broad-spectrum knowledge doesn't ensure that they can answer questions about diversification of the Yen or the latest tax ruling on thoroughbred foals. A Financial Planner is going to be an honest professional and tell you I don't know. Be realistic, the Financial Planner is there to help you make decisions and if you are interested in specific subjects, you are going to have to do a lot of work for yourself. The best way to use a Financial Planner is as a second opinion on you financial plans. Institutional Dealers and Independent Dealers don't see making profit as their reason for existence. In some cases, all the money is ploughed back into making advisers better able to operate. Typically, Financial Planners have more client-facing time and can generate more revenue and therefore more profit for the dealer group.

Financial Planners Looking For A Lifestyle

There are many demands placed on Financial Planners, enormous workloads, working 80-hour weeks. The future today is in practice management, looking at design and implementation of system processes, extricably linked to be a value chain to support Financial Planners.

Platforms that operate on this basis, those that innovate rather than replicate, and those that invest heavily and successfully in technology, have a better chance of success than the rest. The smaller master fund or wrap account operators will seek out these providers and out-source their platform development and operation to them. This saves them the massive cost of the required technology development in this competitive market, while allowing them to focus on their core competencies.

It is against this background that the number of platforms will consolidate while product operators proliferate. But these operators will be running their products and services from fewer and more sophisticated platforms. The way forward for wealth management services lies with the advice givers and their organisations. They will own the product, own the asset and they already own the client relationship. Wealth management providers that are unable to adapt their business to this paradigm will lose the battle and those that are busy replicating current or past business models have already lost the war.

The Noble Planner

Financial Planning will become the most important profession in the 21st century because it's dealing with money and money is at the heart of everything.

Money is embedded in everything we do. It's a powerful, perverse and unilateral force on the planet. Its what helps us understand what is important and what is critical about money. People even today are being called to financial planning, the way doctors, lawyers and theologists are called to their profession - it is a real strong sense of calling.

As a profession, its calling requires a specialised knowledge, minimal education curriculum, enshrined in the legislation by the Financial Services Reform Act (FSRA). PS146 is strong evidence that the public watchdog authority (ASIC) has set minimum standards requiring specialised knowledge, often long and intensive academic preparation.

It's not only a changing business landscape as Financial Planners, who have to be a business person as well as a financial planner and have to support their own infrastructure, are looking to a Platform Provider or Dealer Group to provide the efficiencies on a larger scale that helps them run their own practice.

This is pushing Financial Planners to position their business for future success to a niche market that they differentiate between holistic or wealth management.

Risk Associated With Accumulated Retirement Plans

Until two decades ago, most Australians with Superannuation were covered under defined benefit plans. Since then, the move to accumulation plans in Australia has been massive representing currently approximately 90 per cent. Although accumulation plans provided access to diversification providing risk sharing across classes and individual securities for any one investor and pooling funds providing economies of scale, thereby reducing the cost of individual investors and providing access to a wider range of investment possibilities - the accumulation plans retirement benefits are uncertain, being dependant on the level of contribution and financial returns earned by the scheme the member invested into.

The risk of poor investments performer is carried by each member. With people changing jobs more frequently, a reduction in the life of corporations, greater participation in Superannuation and the demand for portability accumulation plans have many advantages. Accumulated fund members with market-linked returns will receive benefits determined by investment returns over their specific investment horizons.

Members of Accumulation funds should consider the following management practices of risk sharing across generations:

- You should reduce the risk of your investment mix so your investment horizon gets shorter and your investment horizon should be measured relative to your life expectancy, not your date of retirement.

- You can carry greater risk of investment underperformance while you are working if you defer your age of retirement and/or increase the level of saving.

- The risk of investment underperformance can be reduced through choosing a less risky mix of investments; however, this will reduce the expected return and increase the risk of not having sufficient funds in retirement.

- Risk of investment underperformance after retirement can only be compensated for through spending less.

There is a rational reason why accumulated fund members together with their Financial Planner must pay even greater attention to risk management than the traditional defined benefits plans. Members bear all the risk of investment underperformance but nobody really wants to relay in the intergeneration risk sharing offered by the Age Pension which provides the basic benefits level (25 per cent of average weekly earnings) for those whose personal savings are inadequate for a variety of reasons, including investment underperformance. If the overseas trend is any guide, deregulation of industry Superannuation funds represents a huge opportunity for Financial Planners with special Risk Management software, like the BCM.

D.I.Y. Investor Very Much An Amateur Player

The democratisation of investment is a powerful factor in Australia but it can present dangers in turbulent times like the present. Given people's ability to buy shares in privatisation or to select their own mix of managed investments or to make the investment choice in their own Superannuation fund has been the fashion referred to in approving terms such as empowerment and freedom of choice.

No one queries this when the stock market is rising and even investment novices can appear to be geniuses but when times have been tough, who wants to grapple with investment discussions. What the advocates of Do It Yourself investments don't tell the participants is that over time, such amateurs make less on the upturns and lose more on the downturns than the professionals. This is part of the reality of the zero sum game in investment markets.

In recent down markets, some amateur investors will have been scared into selling out of shares, which have fallen, or managed funds which have under performed. Thus amateur investors may have bought on the way up and sold at the bottom.

Several studies of managed investments have found that the average investor under performs the theoretical performance of a fund up to 50%. This is critical when it involves Superannuation savings.

Financial Planners Made To Use Portfolio Risk Modelling Software As A Compulsory Requirement

How to assess the investment needs of clients - knowing the client before settling on the right investment portfolio for them is of course a statutory requirement for Financial Planners for pre-planning risk profiling.

Assessing the client risk thoroughly is one way for Financial Planners to safeguard themselves against future claims by a client. Clients are taking a more aggressive approach than they did a few years ago and are looking for someone to blame when their investments don't perform as well as expected. The real risk for Financial Planners is that they are responsible for explaining the risks a client may come across even though there is no way they can explain them all.

Even if you have made every effort to explain the risk, there are smart lawyers out there who will say the client didn't really understand it. To overcome this problem of assessing risk tolerance, firstly a client must acknowledge and sign a document at particular stages in the planning process such as acceptance of the proposal and receipt of the privacy statements and document acknowledging potential risks. Unfortunately, we are forced to lumber the client with reams of paper. Bureaucrats have no idea of what it costs to be compliant and getting the client to sign documents at every stage makes them suspicious and gets in the way of the client relationship.

The client is also shown the mix between the asset sectors in their portfolio and the way in which this mix can be used to maintain balance in the portfolio through an investment cycle. While most financial planning companies appear to have some sort of risk management strategy in place, a recent survey showed that while there is a superficial agreement to knowing your client, many planners are confused about definition of risk profiling. Some Financial Planners saw risk profiling as an investment management lead to an asset allocation strategy. Others saw risk tolerance as distinct from client investment goals.

Whilst the Financial Planning Association (FPA) has developed some standard definitions, there is some work to be done in developing benchmarks if the financial planning industry is to keep its insurance premiums down, avoid law suits and more importantly, maintain the trust of clients.

In general, when we look at the clients -

- It's not a question of emotions and subjectivity

- Quality income streamline needs

- Assess their risk tolerance to a set of investor style risk types

- Quantitative analysis tools so people don't get big surprises in their portfolio.

- Do they feel comfortable with negative returns?

- How do they feel with a range of returns between 1-19% pa., 2-12% pa., 4-8 % pa.

Legally, Will Risk Profiling Protect You?

Risk profiling is a necessary component in liability management. Does this mean that profile investors will never complain about their portfolio volatility because they are tailored to their personality, according to a risk-profiling tool but how accurate is this risk-profiling tool. The interesting question is will the planner (or his insurer) pursue a claim against a promoter of a risk adverse tool ensuring that all recommendations would be appropriate to a client's personality are legally defensible.

However, one of the dangers of risk profiling is that it can lead one to think if a client can cope with risk, should they be given it. The planner's problem in defending a claim is that it must be acknowledged that the advice has not been based solely on the client's financial position and the advisors view on the markets but also on the client's purported risk profile. If might not be a comfortable position for a financial planner to explain that he chose to invest heavily in the stock market on behalf of a client not because he necessarily thought that it was an exceptionally good time to enter it, but because he believed that all people of a certain type should always invest heavily in the stock market, irrespective of the market conditions.

My belief is that if the volatility inherent in that advice could be too challenging, then it needs to be explained to the client, including the extent to which the advice has been composed to accommodate that. On the other hand, if the advice that is considered most appropriate to the client's circumstances involves relative low volatility, then it should be given even if the investor is a real adrenaline junkie.

The BCM Software Recognises The Intent Of The Financial Services Reform Act (F.S.R.), Promoting Risk Management Systems, Product Understanding And Disclosure Principles And Outcomes

As a general rule, Financial Planners don't undertake a rigorous enough risk analysis of a client's portfolio after first determining what risk means to the client and the definition of risk from an investor's point of view, is quite different to that of a fund manager. I think what investors really mean in terms of risk, is the risk probability of losing their money against the risk probability of expected return.

Risk, Return and Time are the three key factors at the heart of every successful investment strategy. Although their importance is easily recognised, it is often a difficult task to illustrate the interaction of these variables with each asset class.

It helps to make a realistic assessment of the clients time horizon and if their appetite for risk is probably quite high, you can put up with fluctuations in investment returns on the basis that growth assets like Australian and International Shares and special hedge funds will provide the highest return. If, on the other hand, you have a short time horizon, say one year, then you have a low appetite for risk and will probably wish to be in more defensive assets.

As investors, we can choose to invest our savings among a multitude of different asset classes with the underlying desire to generate a return. Ideally, this return will exceed inflation and maintain/grow the purchasing power of our savings. The form of this return, whether it is income capital gain or distribution of income in the form of dividend income, interest or rent or a combination, depends on individual objectives or circumstances.

One of the main influences on the expected value of your return is the risk you are willing to take. To this extent, it is therefore important to understand the relationship between the risk and return. In general the higher the expected return, the higher the associated risk. If you are risk averse, you are more likely to invest in low risk/return assets such as cash or government securities, while if you are more comfortable with risk, you may choose to invest in assets such as shares, which typically have a higher risk/return profile.

Historical evidence suggests that higher risk assets have outperformed their lower-risk counterparts over the longer term (minimum 5 years) though over the short term, significant volatility in capital value can be experienced. It is therefore recommended that higher risk investments are generally suited to investors with long-term investment horizons.

The Old Law on Risk When Formulating Appropriate Investment Strategies

PS 122 and S851 of Corporations Law - Financial Planners have implied general standard of care obligations when making full needs analysis.

Rule III - F.P.A. Rules of Professional Conduct - Financial Planners shall provide an explanation of the nature of investment risks in terms clients are likely to understand.

Financial Planners role is not to avoid risk altogether but help clients embrace and manage reasonable investment risk to achieve desired investment goals over realistic time frame.

Studies have shown there is no single dominant methodology used in the financial planning process to assess a clients risk tolerance other than the industry uses several ways of qualifying risk tolerance.

- Clear description rather than quantification of potential risk

- Education process

- Diagnostic questionnaire

- Comparing and contrasting appropriate one in five risk asset allocation

- Tolerance testing questionnaire are specific which allows gap analysis, ie. The clients current position, financial goals and how the goals can be met, given their time frame and risk tolerance.

- Pick a point on a line indicative of their risk tolerance

- Lifestyle questionnaire; care should be taken - each investor has some unique needs and attitudes

Under The New ASIC PS 146 Compliance Regime

The Federal Government ministers have taken the view that people ought to be capable of buying the right Superannuation product but that doesn't guarantee anything, just like they shop for a house or a car. Superannuation funds and other investment products are not something most people regard as a need that they want to budget for such as a house for shelter or a car for transport. Therefore, to overcome this apparent lack of interest to desire Superannuation as a compulsory product for retirement, the Government came up with the ingenious and cost effective plan known as PS146 Compliance Solution that would abridge this information gap.

In other words, there is a mismatch of knowledge when a financial product is being sold to the general population; such as the seller knows all the information and the buyer knows a lot less. For example, in "Accumulated-Type Super Funds" as compared to the "Defined Benefits Superannuation Scheme" the investment risk is carried by the fund members, therefore no one can forecast precisely what they will receive in the end or how long the product will support income in retirement.

So how can the public be sure that when they consult a Financial Planner they are going to receive independent impartial financial advice; easily by the extension of the new ASIC PS 146 compliance regime for Financial Planners, this could become part of Canberra's argument that it doesn't need to spend money educating Australians on this matter.

PS 146 Knowledge and Skill Requirements

Generic Knowledge

| PS | Topic | Demonstrated Competency Requirement |

|---|---|---|

| 146.119 | The economic environment | Broad understanding of economic environment and impact on markets, including economic and business cycles, interest and exchange rates, inflation and government/fiscal policy, |

| 146.120 | Operation of financial markets | Broad understanding of financial markets, including roles played by issuers and intermediaries, structure of markets and inter-relationship of industry sectors. |

| 146.121 | Financial products | Broad understanding of financial products, including product concept and risk factors, investment classes and sub-classes, types of product; and correlation, similarities and differences between products. |

| 146.122 | Taxation | Broad understanding of the taxation issues relevant to products and markets subject to advice. |

| 146.123 | Disclosure and compliance | Broad awareness of disclosure and compliance obligations, including legal principles, ethical and regulatory requirements; complaints resolution; industry codes of conduct and practice and regulators' guidelines. |

| 146.124 | Integrity | Broad understanding of ethical advising in relation to the relationship with the client, disclosure and conflict of interest. |

Specialist Knowledge

| PS | Topic | Application of Knowledge Requirment |

|---|---|---|

| 146.126 | Financial Planning | Apply knowledge of investment theory, portfolio management and investment risk; advisory functions; taxation and estate planning. |

| 146.127 | Securities and futures markets | Apply knowledge of equities, derivatives and futures; operations of securities and futures markets; types of products; client risk profiles and investment strategies, taxation and disclosure/compliance. |

| 146.128 | Managed Investments | Apply knowledge of underlying product knowledge; concepts of collective rights; taxation implications and regulatory/legal obligations. |

| 146.129 | Superannuation | Apply knowledge of the operation and management of Superannuation markets, taxation implications and disclosure/compliance. |

| 146.130 | Insurance | Generic - apply knowledge of operation of insurance markets; insurance products; taxation; advisory functions and disclosure/compliance. |

Skills

| PS | Topic | Application of Skill Requirment |

|---|---|---|

| 146.131 | Skill Requirements | Apply skills applicable to establishing client relationships; identifying and analysing client objectives, needs and financial situation; developing, presenting and implementing appropriate strategies and solutions; maintaining records; ongoing service and compliant resolution. |

Integrity

| PS | Topic | Demonstration of |

|---|---|---|

| 146.132 | Integrity requirements | Observance of ethical behaviour in relation to disclosure and compliance; compliance with professional obligations in professional/industry guidelines or Codes of Conduct. |

Finally, The Business Coach Model Adopted As An Entire Package For Desktop Interface

The BCM finely tuned Investment Portfolio Construction process endeavours to introduce a thorough, easy to understand and user-friendly information of technology that would produce concrete measures to bolster research and discipline framework of in-depth benchmark filters to improve technological education for the client and kick start a new industry development for reducing fee structure for the clients at a time when the Financial Planning industry needs to be more professional and the investment sectors have been hit by a global downturn.

The advantage of BCM is you don't have irate customers or problems associated with the market because the system places great significance on educating the client so that you don't have difficulty down the track.

However, at least the Financial Planner will be able to justify his fees by having at his disposal the utilisation of the due diligence analysis according to our quadratic (4) filter disciplined process for risk/performance, results in an upward/downward pressure on fund managers or shares which generates tactical asset allocation for long/medium and short term decision.

Because the client perceives that the planner does not have a systematic, transparent value-added disciplinary portfolio valuation mechanism in place, they see this as a failure and therefore the level of fees as a failure.

Research is invaluable as the Dealer Group's responsibility is for advice given to investors and the commercial well being of all authorised representatives.

Our statistical landscape Portfolio Construction Interface System offers access to an exclusive or customised list of wholesale Managed Funds and ASX Listed Securities, (1000+ and 2000+ respectively), Sector Specific (41 and 27 respectively) with multi fundamental filter disciplines (80 and 47 respectively) and together with one of the most comprehensive array of Practice Management and Strategic Calculators that provide a much needed comfort zone to the ever-increasing complexities associated with investment consultancy and holistic financial planning practices.

The performance and feed back from clients and select Financial Planners has been really good. In fact, our system outperformed its peer group has become something of a habit.

BCM can be installed as a bolt-on or web-based client centric business process and automation system within the practice as well as providing the intranet and Directors console for visibility over the delivery of services to the client.

The system also works with a third party client investment platform to allow total control to the Financial Planner. Additionally deploying the workflow automation has allowed BCM to gain huge efficiencies, an example being the reduction of the time taken to complete the construction of a client' portfolio from analysing a client risk tolerance to gap analysis of appropriate asset mix stock selection, together with an income statement and market watch schedule requirement print out.

Savings like these cannot be gained by mere quality control systems tied to one application.

Introduction To The New Paradigm

Changing times and unpredictable markets mean short and long term portfolio assumptions selection risk management which may need to be challenged and to explored new methodologies that fund the right mix of investments. The Business Coach Model's modern portfolio theory as a unique way of dealing with systematic risk and non-systematic risk being one of the finest practice method for acquiring active risk management skills) systematic structured optimisation acts as compliance management plan otherwise it can get really complicated without such a the required tools.

The main goal of the BCM's process system to instantly capture and provide a robust high standard of systematic usability of a full core spectrum approach(quantitative qualitative/mean variance/fundamental) process for absolute portfolio selection capability as to reasonable proxies for premium which the investor is prepared to pay. The BCM's tests these specific driven skills and experience of a tradition portfolio management. The proof of the purity remains in the knowledge gap analysis processed through systematic building blocks flexibility technique. However static prior art satellite core optimised asset class/asset allocation mix are flaunt with danger because the failure to be able to demonstrate with an interfaced scenario testing mechanism creditability that is required for displaying the dynamics associate with risk/return outcomes of the matching asset mix according to the client's/ investor type risk tolerance.

-

Scientific Risk Profiling Reporting System (Hide)

- Scientific risk profiling reporting technique(conservative moderately conservative/ balanced/ moderately aggressive/ aggressive) makes the next efficient frontier

- Multi-filter provides implied capital protection mandate for clients risk profile

- Through unique clients risk profile due diligence style one on one/ isolation technique provides implied compliance capital protection

-

Investment Selection Process Analysis System (Hide)

-

Systematic Building Blocks Flexibility Technique

- The importance of systematic building blocks to enhance portfolio structures

- Structured building blocks process understanding a myriad of information of unbundled assets into asset classes and sub-sectors

- Systematic building blocks flexibility technique for extracting Alpha

- Systematic building blocks capable of hacking the universe that can construct full core spectrum risk/return purity for portfolio selection

- Systematic building blocks continuously driving up Alpha

- Best of a breed and sector specific selection approach processed through systematic building blocks

- A powerful and predictable ranking selection system needs a robust and systematic sectors and building blocks technique

- A broader micro/macro knowledge gap system review searches for Alphas by sectors

- Proper symmetry of distribution offers good opportunities as well as provides capital protection

-

Historical Evaluation Mean Variance (Quantitative)/Forwarded Valuation Fundamental (Qualitative)

- Improving the risk/return estimates using traditional quantitative/qualitative valuation models

- Improving risk/return estimates through quantitative/qualitative concentration models

- It's a risk valuation systems specificity developed for separating out the efficiency of Alpha management(non-systematic micro) from Beta markets (systematic macro)

- The aim is to seeks Alpha driven solutions by sector ranking technique

- A systematic instrument continuously extracting Alpha

- Its about extracting core spectrum Alpha at the highest usability standard practice aim at superiority selection in analysing the universe for skill driven traditional

- Market multiple product selection process knows how to select pedigree investments by looking what's behind them

- The main aim of Alpha selection process is its superiority in analysing the universe for skill driven traditional

- Intrinsic value selection technique enable to create good opportunities for out- performances/low volatility

- Bottoms-up multiple selection process knows how to select pedigree investments by looking behind the fund manager

- The purity of a full core spectrum capable of hacking the universe for a pedigree selection

- Superiority in analysing innovated techniques to be able to hack the universe for various skills driven efficient Alpha/Beta pedigree selection

- Achieve the purity of the forecasts through a proper full core spectrum risk/return ranking analysis

- Makes it possible to understand why some are less market related and don't measure up to the best practices

- Best of a breed through multi sector specific truly lines up on par with good investment opportunities

- A selection process that expresses reasonable proxies for premiums

- Extracting Alpha mechanism makes a powerful prediction that creates reasonable proxies for premiums that investors are willing to pay for it's superiority

- Put simply the separation of Beta from Alpha needs to be done as a reality check coming from dud managers

- The main aim of Alpha selection process is its superiority in analysing the universe for skill driven traditional

- Alpha should be constantly searching for efficient frontier where- by sufficiently reward for risk/return

- The mathematics you can get from a traditional active managers is a huge question

-

Information Arbitrage Analysis Technique

- Information arbitrage matching facility not only creates the traditional mean variance/optimisation method but to think about the asset/liability/ fundamental problem improving risk/return estimates through information arbitrage concentration models which tend to make a optimise positions

- Should look behind investment that considerably out-perform the average benchmark

- Multi ranking systems meets the knowledge gap approach for extracting Alpha

- Deriving Alpha expectations by strategically managing risk/ return for matching investment opportunities

- Potential value - add through matching characteristics between mean variance fundamentals and optimality

- Proper mis-pricing analysis for strategic optimisation make it possible for better risk reward opportunities

- Micro/macro knowledge gap feedback methodology

- Micro/macro normalised back testing technique for core spectrum that make up reasonable proxies for premiums

- Micro/macro knowledge gap feedback methodology needs back testing to be consistent with each other

- Through intrinsic value selection technique enable to create good opportunities for out- performances

- By combining two or more expected Alpha markets reduces positively impacting risk yet at the same time negatively impacting returns

- As part of the knowledge gap feedback problem is being able to read the micro/macro symmetry

- Micro/Macro core selection process through/ market/ sector/relative strength/trends

- A Micro/Macro console information arbitrage facility based on structured format technique for efficient frontier

-

-

Strategic Portfolio Optimisation (Hide)

- The construction portfolio optimisation system is interdependently linked by the asset allocation technique only hence based on a current robust quantitative/qualitative statistical data. This strategic approach makes a meritorious bottoms-up investment decision rather than top down bottoms-up procedural exposure of the asset class function

- Multi strategic structured optimisation makes it easier to utilise the core investment and surround it with low risk/ high performance specialists to protect capital

- Has the ability to focus on one on one type case studies as to the specific relativity outcomes

- A portfolio of multiple managers utilising multiple strategies processed through systematic building blocks

- Potential micro/macro core selection are put through several standard capital asset pricing model types processes that can determine the most desirable outcomes

- Portfolio optimisation analysis system makes it easier to protects capital

- A suitable choice across the board relies on the systematic building blocks for extracting Alpha

- Strategic portfolio optimisation makes a targeted efficient frontier

- Multi structured selection process represented for Statistical verification system

- Has the ability through scenario testing to allow optimisation whilst its processing for value add

- An excellent risk management tool which can deliver returns with a much lower over all risk correlation

- Efficient frontier processed through the all important systematic building blocks

- Portfolio construction approach to efficient frontier

- Separating market risk(systematic) from management risk (non-systematic) enables predictability from such trade-off and respective outcomes

- A knowledge gap technique being able to read the feed back through sensitive micro/macro building blocks

- Efficient frontier processed through systematic building blocks

- Provides some of the finest practice methods for acquiring the best of a breed that decision maker could adopt in order to enhance their skills

- Acts like a compliance investment plan

- A back-end macro knowledge gap analysis process for mis-pricing asset class/asset allocation predictability

- The selection/asset classes/allocation is conditional on a purity upon a set of variable and forecasted economic conditions

- Capturing absolute risk/return for typical investor style type utility function mix consistently using traditional economists consensus models

- Strategic asset class/asset allocation benchmark processed through systematic macro building blocks

- Strategic portfolio optimisation makes the efficient frontier.

- As a significant factor modelling forecasting tool the need for a scenario testing analysis process system

- Prior art satellite core optimised asset class/asset allocation mix are flaunt with danger

- Capturing risk consistently using traditional quantitative/ qualitative/ mean variance/ fundamental/ valuation models

- Optimisation processed through systematic building blocks

- If we can find that synergy and stay with it for some time we should have a superior outcome

- A true feeling of discretionary power over achieving clients/members goals and objectives for trading off their perceived risk against the portfolios perceived risk

- An optimised efficient frontier are forecasted on a purity Of core spectrum risk/return that operates across a robust global and domestic universe

- The only free lunch comes from proper portfolio so as to ascertain the efficient portfolio construction

The True Value On Asset Management Competence

Asset Consultants/Financial Planners should regard planning as something that they do for their clients rather than something that they do for themselves. Asset Consultants/ Financial Planners know that the planning process for clients provides objective goals, accountability and commitment that ensures their clients continue to do what they have agreed to financially, even when they are not feeling motivated to do so, because their adviser is following them up and keeping them accountable.

In seeking commitment from clients to a planning process, most advisers are asking that their clients take a "leap of faith" in their services to ensure they meet their financial goals while reducing their financial concerns. Most advisers, conversely, are not taking a similar "leap of faith" to commit to a planning process to achieve the aims that they wish for themselves and their business.

Most advisers worldwide have become domesticated. Most of them have ridden on the back of an equities boom and it has been quite comfortable to leave the pricing discussion up to the manufacturer of the product/portfolio and the ongoing performance discussion to the immediate past performance.

What Does It Mean To Measure Risk (Hide)

There has been a big difference between measuring risk and perceiving a risk. The standard method used to answer this question endorsed by years of industry practice is to measure the tracking error of the manager relative to some benchmark.

-

Perceived Risk By The Advisor

Tracking error has too-obvious deficiencies:- The total volatility is mixed with upside and downside risk - upside doesn't matter a lot.

- And it's measuring relative to household. We need to look at perceived risk through the eyes of the client

-

Perceived Risk From A Client

In this regard, we are engaging with a client's perception. The client's perceive risk through psychology and the latter emerges strongly when returns are negative as we know.

We need to look at risk with fresh eyes from the vantage point of a client. Since we uncover how risk is perceived, we can devise a risk measure that is relevant to that client. We can all sleep a lot happier at night knowing how close we are engaging with those members' perception of risk. This is accepted that every one member perceives risk differently from older clients close to retirement.

By asking questions about our client's attitude to risk, we understand a deeper feeling. As it turns out, the frequency of the bad outcomes is one thing we all consider when we assess risk but we are also wary about the magnitude of the disaster.

-

Shock Of The Consecutive

There are a number of psychological bias we are dealing with at the moment. After 2 to 3 years negative returns, they are still suffering from the shock. In theory, normally one would predict negative returns 1 in 5 or 1 in 7 years.

-

Strategic Asset Allocation

Again we go down the engineering root that it is not in the member perception of perceived risk to meet their long-term objectives. The plan comes home to roost in a bear market and the client means by long-term returns is absolute returns. We can think about these low returns with low risk. This means that we approach our investments from a stand point that forces us to search for assets and strategies that protect capital and generate income over a reasonable time frame. We can immediately reject broad sharemarket extremes and benchmarks, and commence the hunt for assets that help achieve these goals. At each stage, we avoid taking large risks on the direction of stockmarket. It's terribly important to monitor our progress with periodical reviews and take appropriate action when necessary.

Portfolio Risk Management (Hide)

Changing times and unpredictable markets mean long term assumptions about portfolio risk management and portfolio construction may need to be challenged and new methodologies explored by a new breed of advisers. BCM's approach to all risk, all performance and all asset class, may not control omnipotence (all powerful, almighty invincible) but at least may spare the pain of putting all your money in an ad hoc information arbitrage system that may go wrong.

Therefore, the more you put your investment on "auto pilot", Attribution Construct Selection Process, Blending Multi Managers/Shares Portfolio and Strategic Optimisation Through Portfolio Construction, the less risk that you will crash them. Because a computer-driven model is far superior than the human brain in analysing, sorting, scoring and evaluating because of its limited capacity in aggregating literally thousands of calculations in a split second.

The new paradigm co-efficient correlation approach would also require advisers to manage the risk posed by high market valuations for both funds management and shares by using several new methodologies for rapidly valuating efficient Alpha (absolute returns)/Beta (benchmark relative) markets such as Attribution Construct Selection Process, Blending Multi Managers/Shares Portfolio and Strategic Optimisation Through Portfolio Construction.

Ultimately, this new model of investing would present advisers with unique challenges for portfolio construction and selection process of investments. Some of these challenges include which valuation methodology to use, how to properly assess the market cycle, macro rotation asset allocation strategies, what to do when the market forecast is unclear, how to communicate the new paradigm to clients and how to organise a practice to make good portfolio decisions.

-

Attribution Construct Selection Process

The aim of this selection process is the total attribution or the market multiples score of the absolute risk/return co-efficient, are the reasonable proxies for premiums that investors are willing to pay for investment risk and it's superiority in analysing the universe for skill driven traditional fund managers/shares with the innovated techniques to be able to hack various fund managers/shares and components to make up those adjustments where they are needed. Likewise to the technique of an absolute return/risk strategy measured against relative benchmarks to finish up with an efficient Alpha/Beta portfolio.

The strongest aggregate consists of each weighted asset class with the highest aggregate score in the portfolio based on its relative merits of fund managers/shares within a strategic model portfolio based on historic and forward returns, volatility and correlation for shares/fund manager by sectors tend to remain the strongest for some time. If we can find that synergy and stay with it for some time, we should have a superior outcome. The next thing to do is decide how it fits the portfolio.

Investors should look behind the fund manager to look at the pedigree of the management of how they manage money. Good fund managers have been spawned out from the traditional major fund managers space.

We manage by an absolute return sense (everything you want to know about an investment can be revealed about it in its mean variances or fundamentals) based on historical returns, volatility and correlation but also benchmark relative which is the target indicator for Strategic Optimisation through Portfolio Construction (See 3 below). This means when the markets don't perform well as in the earlier years of the five year review period, we are still able to add value in an absolute sense.

In other words, funds/shares ranked by attribution method have considerably outperformed their respective multi benchmark over the period which clearly shows our strategy enables you to add value to clients to both positive and negative markets.

-

Blending Multi Manager/Shares Portfolio

Portfolio blenders need to find ways to mix managers without over diversification of their portfolios. Investors would do well to heed Warren Buffet's comments: "Wide diversification is only required when investors do not know what they are doing".

In order to understand a market or managing risk in a multi manager portfolio, you need to focus on the risk structure, exposure to specific stock but right down to add value. We all have a set of beliefs backed by research, idiosyncratic skills. The thing that is placed on them, be it high conviction or low conviction, is that this is diminishing returns for added risk until favourable forecasted earnings. We can improve performance of that manager by being overweight in that fund manager, yet at the same time to maintain an acceptable overall portfolio risk by neutral style tactical asset allocation (equilibrium offset of risk exposure arbitrage).

The implication of small size and high levels of concentration of the domestic markets is that these tend to have very high levels of overlap between Australian equity managers portfolios. This poses a serious challenge for portfolio blenders of having too much risk rather than too little risk.

The problem of over diversification is also exacerbated by size. Multi manager providers with large funds under management face a significant challenge as they expand the number of managers used in the equity blend so the level of risk declines further. On the flip side, such large multi fund managers have difficulty in limiting the number of managers they use as this results in very large fund size being given to underlying managers which in many cases aren't in a position to absorb and manage effectively.

In particular, one can customise more concentrated portfolios with the underlying manager and many Australian equity managers have now added such concentration into their main stream process. These mandates may limit the number of stocks the manager invests in or simply focuses the manager's stock selection on their best ideas, so limiting the degree of overlap across manager's portfolios. With these more concentrated mandates, the optional number of managers in a blend could be expanded beyond five.

With such low levels of active risk it is unlikely that the portfolio will generate significant levels of Alpha, certainly not enough to justify the high levels of active fees of underlying active management.

When it comes down to it, there's only one thing we want to know about in the markets is the "Next Big Thing". The latest investment markets providing this new challenge are emerging markets, particularly in the BRIG economies (Brazil, Russia, India and China) and the increasing popularity of commodities and hedge funds. These new paradigm advisers approach to statistic portfolio asset allocation have been able to successfully challenge that portfolio construction investors will be rewarded with excess returns for taking risks over and above the risk-free rate of return.

-

Strategic Optimisation Through Portfolio Construction

The BCM's model through it's benchmark relative indicators such as sector mean, portfolio mean and macro asset class retraceable rotation is a distinctively more secure system for managing excess returns because the equity risk premium which is far more positive and stable so that advisers could safely believe that the historically/forecasted strong long-term average returns of equities would be realised when constructing strategically allocated portfolios.

One of the major challenges facing diversified investment portfolios is finding enough Alpha. Alpha is the value that the BCM can add to the portfolio under management. Investors in an index fund take whatever return they can get from the market (Beta) but a financial planner should in theory be able to add Alpha on top of that.

BCM's system knows how to select pedigree fund managers by looking behind the background of the people how they run the funds, simply resulting from the additional computer driven research filtering models. To find out where they are coming from requires a robust quantitative system to test the specific skills and experience by measuring their track record for excess returns over the benchmark in Alpha (rather than Beta skills of a traditional manager) over a 3 months to 10 year period. It's good to understand why some fund managers are less market related.

Basically, it's delivering what their clients want most, ie. performance at a desired risk because investors cant afford too much downside uncertainty. Fund managers as we know then are becoming obsolete and the reality check coming for dud managers, not just because of the private equity boom, although that's part of it but because on average, they are not good enough to add value to the portfolio.

A revolution is sweeping in from the US that will fundamentally change the way capital is managed and institutional investing is conducted, not necessarily in comfortable ways for those who do it. Investment institutions are fed up with paying extraordinary fees for ordinary performances. Put simply, the new investing movement involves the separation of Beta from Alpha, and paying nothing for the former and plenty for the latter.

At the moment, the idea of pay-for-performance is largely confined to the alternative asset classes of private equity, hedge funds and infrastructure, although these funds all charge hefty fixed-base fees, whatever their performance, on top of their performance fees.

-

BCM Focusing on Quantitative Approach

Focusing on quantitative approach can protect damage control, ie. herd mentality and behavioural bias.

Typically the quantitative approach is built around a broad universe of opportunities and incorporates a sophisticated process for gathering and exploiting investment areas from -

- Multiple data points which variables that have predictive power.

- Uses computer modeling instead of human analysis. i.e Capital Asset Pricing Models(CAPMs)

-

Key to success

To understand quantitative strategies is the quality of underlying investment philosophy (5 investor types) and rigueur of the model (multiple data points for CAPMs, back testing).

Predictive powers can build quantitative shops with a combination of Macro, Historical and Forward Evaluation, Composite Graphs, Analysis Reports, Benchmarks. In practice, this means a better way of holding many positions to generate active returns (being either under or over-weight in many positions). "Obviously if you play the game well, you want to play it more often". In other words, the skill to deliver better returns.

-

Fewer Behavioural Problems with Quantitative Analysis

Fewer human behavioral biases to create inefficiencies such as investors overacting to bad news and too slow to good news. Computer modeling selects stock on historical basis; no interferences with falling in love with stock.

Analysis can cover a huge number of funds and stocks. Repeatability and accountability investment decisions are driven by data - there is less "short-term" Key Man risk as portfolios are built to a benchmark. Always make attribution analysis. More robust and facilitates continuous objective assessment.

-

Quantitative Vs Qualitative

Qualitative Managers use many quaint processes to screen the universe drive trading systems and manage the portfolio risk because after all, it's humans who build the basic operating parameters of their investment models such as Choice of Factors and how to combine these.

BCM has a greater choice of Fund Managers/Direct Shares across the asset classes which is further broken down into sub sectors to combine the dynamics of new and old industry trends across the universe and the influences of both new technologies and macroeconomics, including Emerging Markets and Hedge Funds.

-

Portable Alpha

Ability to use sophisticated modeling through CAPMs system to seek portable Alpha. The high technology nature of CAPMs analysis suggests they may exploit these opportunities more efficiently than qualitative managers. Able to identify sophisticated momentum approaches which traditional managers cannot.ie Short hedging.

Able to build more diversified portfolios which can help isolate exposure to desired sources of Alpha. Manage other market risk and provide greater breadth of bets.

-

Attribution Modeling

By definition Quantitative Managers are naturally equipped to be valuation orientated such as abnormally strong, statistical, and analytical.

Quantitative Managers aggregated analysis isolated broker reports such as re introduced biases tend to be eliminated ie. Forward Evaluation Analysis. Look back biases, excessive data mining and other back test procedures.

CAPMs are effective because they pick up on mispricing caused by irrational trading behaviour to have this performance edge traded away.

BCM's Quantitative Approach relies on CAPMs to build decision-making models yet at the same time through its "Macro Retraceable Modelling" technique is able to cope with inflexion points in glodal trends and economists consensus strategic asset allocation.

-

Even Investment Professionals can fall Prey to Behavioral Biases with Policies and Procedures

- The less investment advisers fall in love with their stocks they cover and it would be a good idea to get critical independent evaluations done.

- Investment advisers tend to be conservative in adjusting their expectations to new information and do so slowly over time.

- Investment advisers in general tend to be overweight in spectacular or personal experiences in assessing the probability of events occurring. This can result in an emotional involvement with an investment strategy if it has been winning recently, an investor is likely to expect that it will continue to do so.

- Investment advisers tend to focus on occurrence that draws attention to themselves (such as a stock or class of asset that has risen sharply in value). Due to this type of above behaviour, they tend to be over confident in their ability. Interestingly, men tend to be more over confident than women which results in men trading more than women and generating poorer investment returns than women. This also says that people require less information to predict a desirable event than an undesirable one (wishful thinking).

- Crowd psychology can have a contagious effect and can magnify errors in an individual's judgement, ie. mass communications, the threat of losing or missing out, financial wealth or a strong belief that share prices can only go down.

- The influence of investor psychology can have several implications for investors, i.e. Investment markets are not just driven by the fundamentals but also by the irrational expectation and erratic behaviour of an unstable crowd.

- Investment advisers need to recognise that not only investors markets are highly unstable but they can also be seductive, ie. buying near the top and selling near the bottom. In other words, investors must be aware of how they are influenced by the lapses in logic and crowd influences or do I have a tendency to be over confident in my ability.

- Investors ought to choose an investment strategy, which can withstand downsides whilst remaining focused on the broad financial goals.

- If an investor is tempted to trade, they should do so on a contrarian basis, ie. buy when the crowd in bearish and sell when the markets are bullish. Extremes of bullishness often signals market tops and extreme bearishness often signals market bottoms.

- The individual investment advisers versus the crowd dynamics occurs to some extent - in the institutional investment market. Here active managers performances may be measured against a benchmark but if they are unable to perform well - for whatever reason - they may end up hugging the benchmark. The outcome of such an activity is that these managers get paid active fees but only delivering index performances.

- One of the key tenets of behavioural finance is that incurring a loss hurts the average investor about 2.5 times as much the pleasure they get out of making a profit. That leads inevitably to loss aversion - we loathe cutting our losses and admitting mistakes.

- One thing we are very good at is recognising patterns so that we sometimes place importance on patterns that are meaningless or not there. For example, the following sequence occurred when a coin is tossed several times: H.H.H.T.T.T. OR H.T.H.T.T.H. Most people believe the second sequence is more likely to occur because it looks more random whilst the first appears systematic even though both are equally probable

-

BCM's Portfolio Construction Ensures Clients Needs Are Continuously Met.

-

Client Risk Profile

For recognising clients marginal risk for an appropriate Efficient Frontier Model, ie. it's the best asset allocation of multi managers portfolio that meets targets such as risk profiles of the clients and lifestyle objectives such as having enough capital to support you in a comfortable retirement.

Clients who invest directly or indirectly will need their investment strategy aligned / or require their portfolio rebalancing to maintain their investment strategy and ensure the risk remains at the desired level.It's a system that offers quasi Capital Protection against capital losses. It has this ability to bundle different assets, Domestic and Global Equities, Emerging Markets, Hedge Funds, Managed Futures, Asset Backed Securities or Collateral Debt, into a single strategic asset allocation.

It makes it easier emotionally to invest in these unbundle assets and far less expensive - argues that it protects capital and delivers gains sought by investors - you don't need expensive Exchange Trade Options to hedge the portfolio.

The key to its success is a regular disciplined approach of investment analysis for populating the portfolio construction as a Planned Manager meets the client's risk profile irrespective of high risk investments.

-

BCM's Moderate Valuation Portfolio

With investment styles wrought with huge disparities in performance in recent years, investors have turned to the traditional theme of sustainable earnings growth, value and yield.

As a general rule, financial planners don't undertake a rigorous enough risk analysis of a client's portfolio after first determining what risk means to the client and the definition of risk from an investor's point of view is quite different to that of a Fund Manager. I think what investors really mean in terms of risk, is the risk probability of not losing their money against the risk probability of expected return.

Risk, return and time are the three key factors at the heart of every successful investment strategy. although their importance is easily recognised, it is often a difficult task to illustrate the interaction of these variable with each asset class.

Part of the problem of knowing when to buy or sell, is that investors have difficulty accessing and understanding a myriad of information that comes in the form of statistics, data and other indicators used by professionals to gauge the markets like business sentiment, investment and employment levels and major commodity prices.

When using a moderate value investment style, two key questions lie at the core of the decision as to whether or not to invest in a fund: -

- is it a sustainable track record and

- does the income distribution offer good value

It is a tough market; therefore you have got to have the latest technical tools that money can buy. The BCM's software encourages the need for greater due diligence from Financial Planners for investors by in-depth gap analysis associated with achieving desired risk/performances of a client's investment portfolio.

-

| Key Terms/Legends | Definition |

| PART A (ACRARRB) | Absolute Concentrated Risk Adjusted Relative Benchmark contains the attribution symmetry selection modelling apparatus meaning as to what a true investment decision making is all about. In other words, the success of an efficient investment outcome is due to its self adjusting mechanisms that implies the only risk that should be rewarded is market risk. Exposure to market risk is captured by beta represented by statistical verification that measures the sensitivity of market returns of the particular security according to core spectrum qualitative/quantitative (mean variance/ fundamentals). Therefore to capture the industry best practices requires a systematic building blocks approach through Capital Asset Pricing Models based on Alpha factor pricing metrics. This flexible and transparent technique has the effect of enhancing the purity of the forecasted relative strength, predictability and sustainability of the fund managers/shares. Thus this approach asks the question surrounding whether these market anomalies are hype or a mirage produced by lack of understanding of the market forces that drive the prices compared to the purity of valuation. |